Should Wall Street be All About the Numbers?

Should Wall Street be All About the Numbers?

This morning I awoke to the cell phone buzzing with text messages that were thanking my hot stock tip. Crazy me sleeps with her cell phone (and iPad) within reach despite common sense. I’m inclined to keep those pesky devices nearby 24/7 – even in bed.

Not entirely sure what fueled this early morning texting; blinking away the sleep I sat up and started reading the dimly lit screen more closely. Turns out my Chipotle blog spurred investment.

Here’s Wall Street’s assessment:

Chipotle (NYSE: CMG ) reported third-quarter earnings after the market closed today and, so far, investors like what they see, with shares up 1.5% after hours. Revenue increased 18% in the quarter, to $826.9 million, and net income was up 15.3%, to $83.4 million, or $2.66 per share.

The net-net on that? Do you want it in human-speak?

Chipotle shares shot up 50 bucks – right after my blog article.

So I got to thinking. Thanks to my early AM text message – this keen insight would have been missed if the devices weren’t glued to my nightstand (am I justifying too much here?) I helped a friend rake in some serious coin.

Wall Street and Hot Marketing Real Bedfellows?

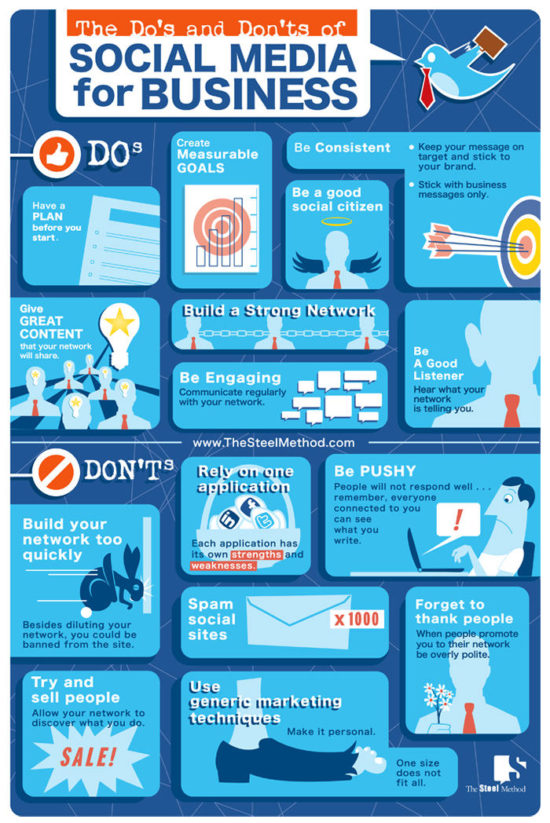

I love stocks and I love marketing. Stocks and marketing – interesting bedfellows you may think. Earlier admission aside, I had to ask myself, is there a correlation between hot marketing and hot stocks?

If you are one to shy away from all the highbrow thinking and long-winded chatter coming from Wall Street, and really want to invest in a stock, know this:

Hot marketing does not happen overnight. Despite the overlay from the land of Don Draper-dom, marketing is far more scientific than one may think. There’s tons of data that inform a company’s marketing campaign. More importantly, there’s tons of data – relevant data that shapes a hot marketing campaign.

For example, Google is well aware of the upward trend for mobile devices. Several studies from Gartner and Forrester expounded the usage of mobile devices eclipse the desktop by 2013.

Well, 2013 is here and guess what? Google has no qualms about forcing advertisers to deal with the transition to mobile and is willing to take earnings hit in the short term.

But still, Google share prices just crossed the $1,000 mark on the Nasdaq Stock Market. Google is trying their new ad campaign to Google+. More importantly, Google is moving towards localization. If you search for ‘Italian restaurants,’ you might see an ad for a nearby restaurant along with your friend’s favorable review pop up. Actually, YOU are the new face of Google advertising, but whatever.

Google+ has over 350 million users according to some estimates. Google’s marketing campaign is synergistic. Relevant data is informing their marketing approach. Google wants to derive increased revenue from the mobile device market. They’re using a commanding lead in the online landscape to pull in tomorrow’s revenue just sitting on the horizon. Easy marketing and well thought out.

Bottom line?

(Using Wall Street speak, but only for one second) Google uses data to help inform their hot new marketing campaign. Additionally, they tie their corporate objectives to their ad campaign.

So the next time you see a bold ad like Chipotle or a well-orchestrated long-term ad-play like Google, or even sing a catchy tune like Plop plop fizz fizz oh what a relief it is (dating myself here, I was just a kid, really, I was), know that these are great investment opportunities for you.

So what does this mean to you?

If you like a company’s ad campaign – buy their stock!